To calculate in Excel how many hours someone has worked you can often subtract the start time from the end time to get the difference. Wide-ranging amendments to Malaysias Employment Act 1955 the EA are now going through Parliament.

Your Step By Step Correct Guide To Calculating Overtime Pay

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

. 2 1 day basic salary 1 day TA 1 day DA X no. But if the work shift spans noon or midnight simple. But overtime can be a very confusing matter.

Transfer payroll entries into your accounting software in just a click of a button. Submit regulatory forms in seconds have EPF and SOCSO automatically calculated for you and generate bank files to pay all your employees at one go. Divide the employees daily salary by the number of normal working hours per day.

1 1 day basic salary X no. If you are interested to know the calculation of the EPF contribution formula you have came to the right place. If the employees salary does not exceed RM2000 a month or falls within the First Schedule of.

How to calculate time and a half. This best payroll software in Malaysia can handle multiple company transactions at a time. At the end of the day keeping track of your leave entitlements and understanding your rights and legal obligations is crucial.

Assume an employee earns 20 hourly during a 40-hour work week. In Malaysia overtime is still popular among companies especially in the FB sector. A person gets a salary of Rs12000 per month and allowed leave days per month is 2.

If you want to find out more about the different types of leave entitlements in Malaysia click here or you can find out about overtime pay rates hereAnd of course for all things HR head over to the altHR resources page. Recall employees status and information. In this article we will go through the computerised method to calculate PCB accurately in four steps.

JustLogin is fully integrated so no pay leave and overtime hours are factored into pay calculations. This is based on the number of days spent in Malaysia and should not. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000.

Leave encashment calculation formula. All such contributions are required by the Malaysian Legislation. It is a simple and easy payroll software system by allowing your company employee SOCSO calculation Malaysia can be done easily and efficiency.

An employee works normal working hours of 8 hours a day earning RM50 on a daily basis. Having different types of payment modes for your employees is not a problem as it can calculate hourly daily and monthly salaries. In addition contributions are also made to Social Security Organization or PERKESO in Malay.

RM50 8 hours RM625. If an employee works overtime make sure to pay them the correct amount as stated in. One day this employee works overtime for a total of 2 hours.

This contribution is paid into Employee Provident Fund or KWSP in Malay. Overtime pay policies vary between companies time and a half being a common rate. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia.

IFLEXiHRMS Payroll System free up your time from tedious and complex payroll calculations preparation. Most used ways are as follows. Which I will explain below the formula to be used to calculate the wages due in these circumstances is.

Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of. Firstly fill in the values for the following employee information. In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws.

Since 2020 the default. Additionally be aware that this payslip template does not calculate taxes. You must do this separately.

Calculate Leave Encashment Payment. Such as entitlement to overtime compensation and limits on working hours. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Different companies calculate it in different way. In addition to monthly salaries Malaysian employers are also bound to contribute to the EPF EIS and SOCSO accounts of their employees. Time and a Half Rate Hourly Rate x 15.

Users can further customise the computation for allowance overtime and shift calculation with a built-in formula builder. Another common mistake made when inputting information into the payroll check template is the incorrect calculation of overtime hours.

Your Step By Step Correct Guide To Calculating Overtime Pay

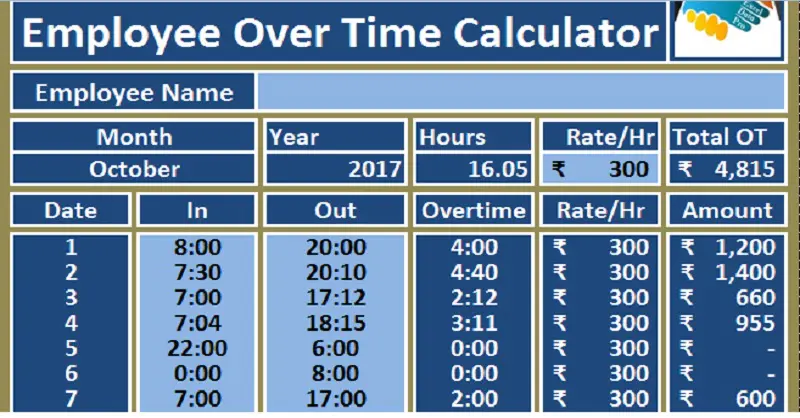

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Download Employee Overtime Calculator Excel Template Exceldatapro

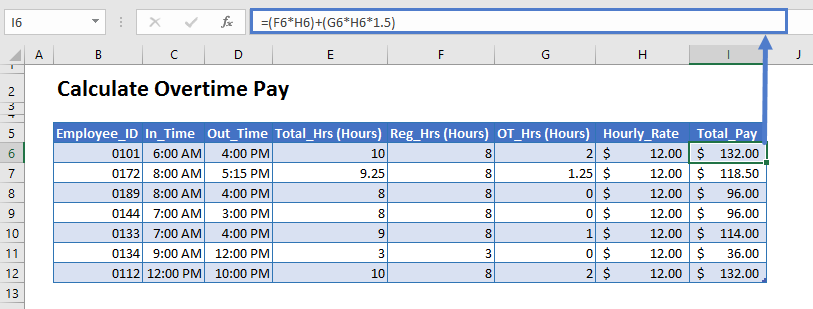

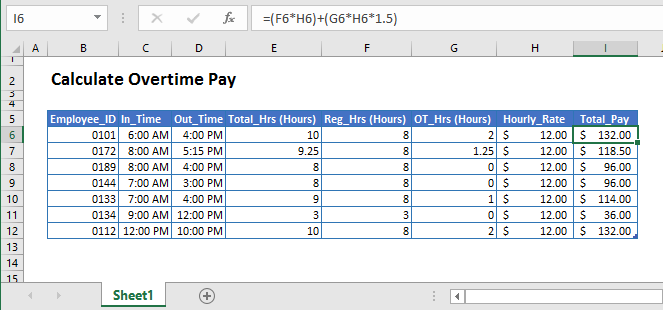

Calculate Overtime In Excel Google Sheets Automate Excel

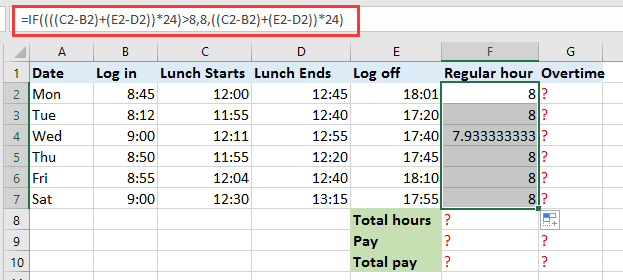

Excel Formula Basic Overtime Calculation Formula

Salary Calculation Dna Hr Capital Sdn Bhd

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Your Step By Step Correct Guide To Calculating Overtime Pay

Calculate Overtime In Excel Google Sheets Automate Excel

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Quickly Calculate The Overtime And Payment In Excel

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Your Step By Step Correct Guide To Calculating Overtime Pay

Calculate Overtime In Excel Google Sheets Automate Excel

How To Quickly Calculate The Overtime And Payment In Excel

Your Step By Step Correct Guide To Calculating Overtime Pay

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

How To Quickly Calculate The Overtime And Payment In Excel